Finsheet.io is a leading provider of user-friendly financial management and analysis solutions aimed at empowering individuals, businesses, and financial professionals. Their innovative platform offers a suite of powerful tools that simplify complex financial tasks, enabling users to gain valuable insights, enhance financial reporting, and make data-driven decisions.

The dedicated team at Finsheet.io is committed to delivering exceptional customer satisfaction and continually improving our platform to meet the evolving needs of the financial industry.

Finsheet.io provides a comprehensive range of features designed to streamline financial management and analysis, including:

- Financial Modelling: Create custom financial models with our intuitive drag-and-drop interface, allowing you to forecast and analyse various financial scenarios with ease.

- Budgeting and Forecasting: Plan and monitor your budget, track expenses, and generate insightful financial forecasts to guide your decision-making process.

- Data Visualisation: Transform raw financial data into interactive and visually appealing charts, graphs, and reports for easy comprehension and analysis.

- Collaboration: Collaborate with team members in real-time, share financial data and insights, and manage user access and permissions for a seamless workflow.

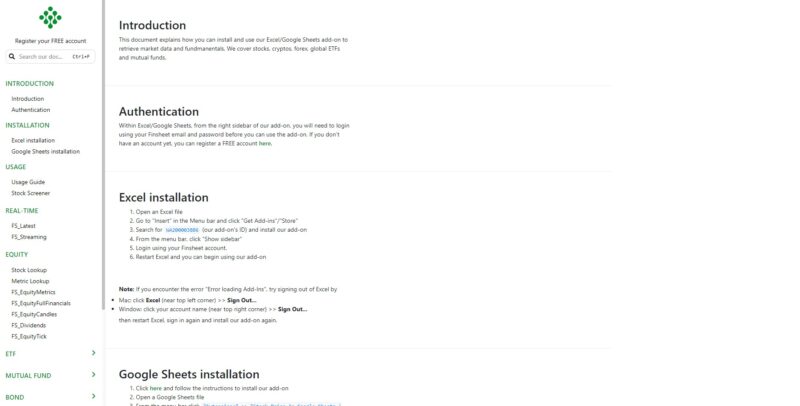

- Integration: Connect Finsheet.io with your favourite accounting software, financial tools, and data sources for a unified financial management experience.

- Security: Protect your sensitive financial data with Finsheet.io’s robust security measures, including encryption, secure data storage, and regular backups.

Who is Finsheet.io Suitable For?

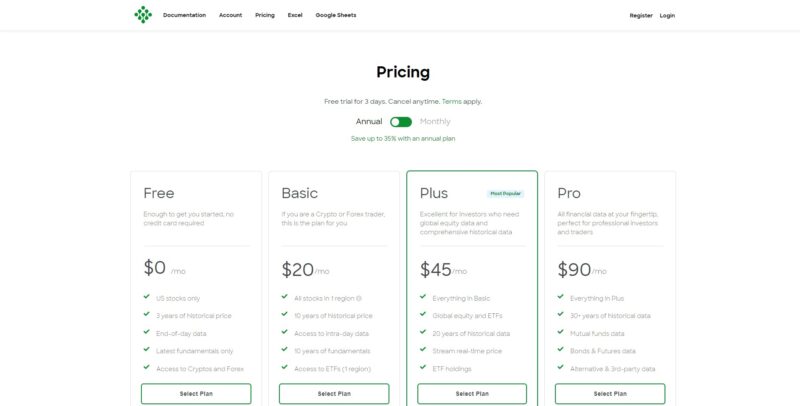

Finsheet.io caters to a diverse range of users seeking intuitive financial management and analysis solutions, such as:

- Small and Medium-sized Businesses: Streamline financial planning, budgeting, and analysis for better decision-making and growth.

- Financial Professionals: Simplify complex financial tasks, enhance financial reporting, and provide data-driven insights to clients.

- Startups: Plan and monitor budgets, track expenses, and generate financial forecasts to guide strategic decision-making.

- Freelancers and Independent Contractors: Manage personal finances, monitor income and expenses, and plan for future financial goals.

- Non-profit Organisations: Track donations, monitor expenses, and generate financial reports for stakeholders.

- Educational Institutions: Manage budgets, track expenses, and generate financial forecasts for better resource allocation and planning.

There are no reviews yet.