TaxGPT is an innovative AI-driven tool designed to help individuals and businesses navigate the complexities of tax management. Leveraging the power of artificial intelligence, TaxGPT streamlines tax-related processes, ensuring accuracy and compliance while saving time and effort.

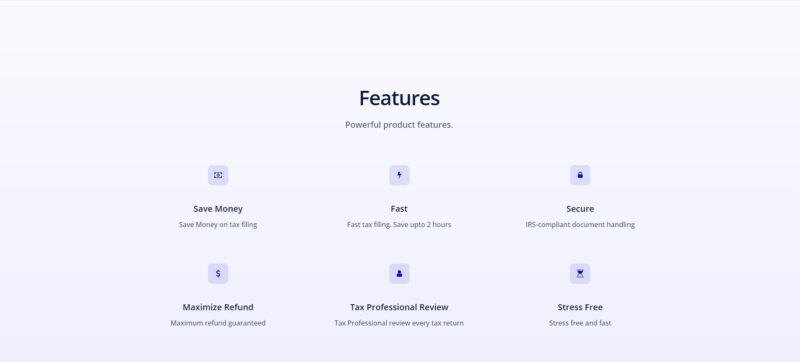

Key Features and Benefits:

- Simplifies tax calculations: TaxGPT’s AI algorithms can efficiently process complex tax calculations, ensuring that users receive accurate results based on their unique financial circumstances.

- Enhances tax planning: By analyzing users’ financial data, TaxGPT offers personalized tax planning strategies to help minimize tax liabilities and optimize potential savings.

- Assists with tax filing: TaxGPT’s intelligent platform guides users through the tax filing process, ensuring that all relevant forms are completed accurately and submitted on time.

- Offers expert tax advice: TaxGPT leverages AI to provide users with tax advice tailored to their specific financial situation, helping them make informed decisions and avoid potential pitfalls.

- Ensures regulatory compliance: With constantly updated tax regulations, TaxGPT ensures that users remain compliant with the latest tax laws, reducing the risk of penalties and audits.

- Increases efficiency: TaxGPT’s AI capabilities enable users to complete tax-related tasks more quickly, freeing up time for other important activities.

- Supports multiple tax scenarios: TaxGPT’s versatility allows it to cater to a wide range of tax situations, from simple individual tax returns to complex business filings.

By harnessing the power of AI, TaxGPT simplifies tax management for users, providing accurate calculations, personalized advice, and efficient filing processes. As a result, individuals and businesses can confidently manage their taxes, optimize their financial strategies, and remain compliant with ever-changing tax regulations.

There are no reviews yet.